Jump to topic

Executive summary

Our energy is a critical strategic concern for Gippsland Water and the water sector more broadly. Centralised water and wastewater service delivery are energy intensive activities. An affordable and reliable supply of energy is essential for the economic and environmental sustainability of our business as well as for continuity of service delivery to our customers.

The cost of energy has increased significantly in recent years as the energy market in Australia undergoes significant changes, driving higher energy prices and greater volatility. The total cost of energy for our business currently equals almost five percent of total operational expenditure. Further, energy consumption is also our most significant source of carbon emissions.

Our energy requirements are likely to increase in the future. Key external drivers of energy consumption in the years ahead include population growth in Gippsland, which is projected to grow by around twenty-six percent over the next twenty years.

Further, a potential decline in rainfall throughout the region as a consequence of climate change may force adoption of new and more energy intensive water sources for some of our systems.

To meet these challenges, we must change our approach to energy management. Historically, we have enjoyed low energy costs in comparison to other operating costs and there has been limited perceived business need for investment in energy management. Without a concerted approach, we remain exposed to several risks, including increased tariffs resulting from rising energy costs that cannot be absorbed by our business, as well as potential service interruptions as energy supply becomes less reliable in periods of critically high demand.

If we are to achieve sustainability and maintain continuity in the future, our business must position itself strategically to avoid market risks and exploit opportunities to reduce costs and generate additional sources of revenue. A considered, evidence-based approach to energy management can potentially reduce energy costs by up to fifty percent while also bolstering capacity to guarantee energy supply and service continuity.This Strategy identifies the key drivers of our energy costs, assesses and prioritises the mechanisms likely to yield the greatest influence on those drivers, and recommends initiatives designed to activate those mechanisms.

In order to reduce the cost of energy, we must adopt an integrated whole-of-business approach to energy management. Accordingly, this Strategy recommends six initiatives that form part of a holistic and integrated approach to influencing the drivers of energy costs in our business:

- Build our capacity to capture and analyse energy data;

- Build our capacity for demand response to the energy market;

- Synchronise our diesel generation to improve business continuity and demand response;

- Pursue energy efficient equipment renewals and replacements;

- Invest in renewable energy generation;

- Adopt an integrated energy management & assets policy framework;

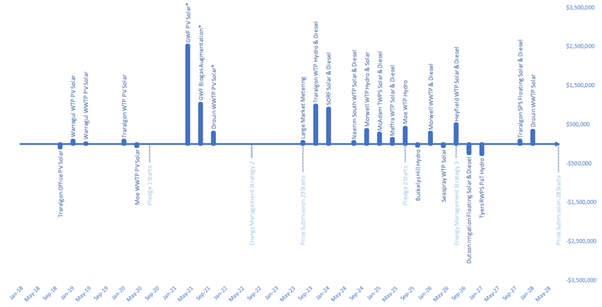

These initiatives are recommended to be executed in a staged manner between 2022 and 2028 in accordance Pricing Submission 2023-2028, with a review of strategic outcomes and strategy update scheduled to occur toward the end of that period.

We have committed to net-zero emissions in the Statement of Obligations (Emission Reduction) under the Water Industry Act 1994 (Victoria). That means we will reduce our total scope one and two emissions to zero by 1 July 2030, with the interim commitment of 32,080 tCO2-e by 1 July 2025.

The Victorian Government Climate Change Strategy also requires electricity used in government operations, including us, to be 100 percent renewable by 1 January 2025.

These policies have informed our Board endorsed environmental decision making principles for our investments in emissions reductions:

- Net zero emissions by 2030 is our minimum aspiration, but the situation is urgent and we are willing to create opportunities to go further;

- Our investment into emissions reductions will consider our customers’ needs and aspirations and for generations of customers to follow;

- Our investments in emissions reductions will be sustainable and the best possible allocation of our available resources towards the best economic, social and environmental outcomes;

- We will look towards partnerships that are consistent with our values and assist us to achieve effective and sustainable emission reductions.

Introduction

Purpose

The intent of this Energy Management Strategy (hereafter ‘this Strategy’) is to provide information and analysis to support our Executive Leadership Team to make well-informed strategic decisions about reducing the costs of energy consumption.

Energy is a critical strategic concern for the water sector, underpinning the most fundamental aspects of water and wastewater services in terms of both economic and environmental sustainability, as well as continuity of service delivery of an essential service to the community and industry.The energy market in Australia is undergoing significant changes, and that change is driving higher energy prices and greater

volatility. If we are to achieve sustainability and maintain continuity, our business must position itself strategically to avoid market risks and exploit opportunities to reduce costs and generate revenue.

Accordingly, this Strategy will:

- Assess the key strategic drivers of our cost of energy;

- Identify strategic options for energy cost reduction and risk mitigation, including opportunities for efficiency, options for investment in energy generation, and potential new capability development opportunities; and

- Provide financial and non-financial impact analysis associated with each strategic option.

- Support climate change mitigation through reducing energy use and providing a strategic approach to renewable energy generation and implementation; and

- Identifying risks to reliability of energy supply and provide resilience for business continuity and service delivery.

Scope

This Strategy will identify the most effective ways we can manage and control our cost of energy with emphasis on those initiatives with best likelihood of significant impact.

Additionally, this Strategy will support our climate change mitigation and adaption strategy insofar as it identifies and implements initiatives that efficiently and effectively reduce its carbon footprint.

Finally, this Strategy will consider options to ensure the continuity of our services in a declining electricity network.

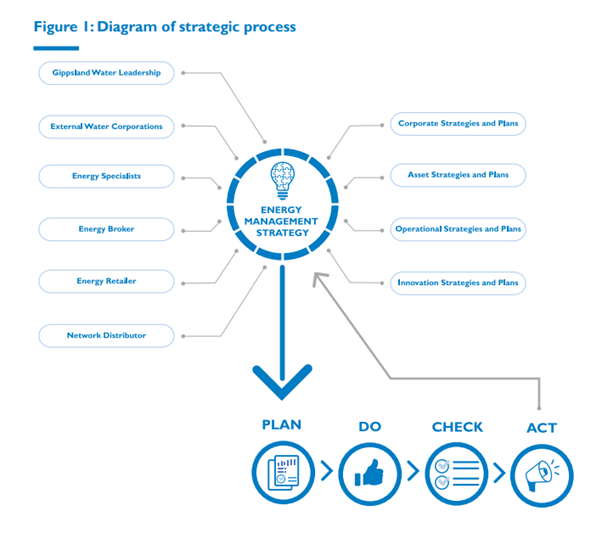

Strategic process

This strategy was developed in collaboration with internal leadership and subject matter experts, external water authorities and energy industry representatives, by completing a comprehensive review of a wide range of energy initiatives to identify those initiatives that were most likely to help gain control over its cost of energy.

We will continually build and maintain this current strategy as we continue to assess the performance of identified current strategic initiatives and explore any new and emerging initiatives. It’s expected our approach to energy management will continually evolve as it assesses the effectiveness of implemented initiatives, learns and adapts its approach to incorporate these learnings as we continue to explore emerging energy management approaches in the years ahead.

Background

Our strategic context

The introduction of climate change policy and the retirement of large coal generation without replacement, has had direct impact on the energy market in Australia. The inconsistent policies of state and federal governments have restricted the influence of market mechanisms and contributed to less reliable energies supplies.

Energy is a strategic issue of critical significance for the water sector. Affordable, reliable and abundant energy is a fundamental necessity for the delivery of water and wastewater services.

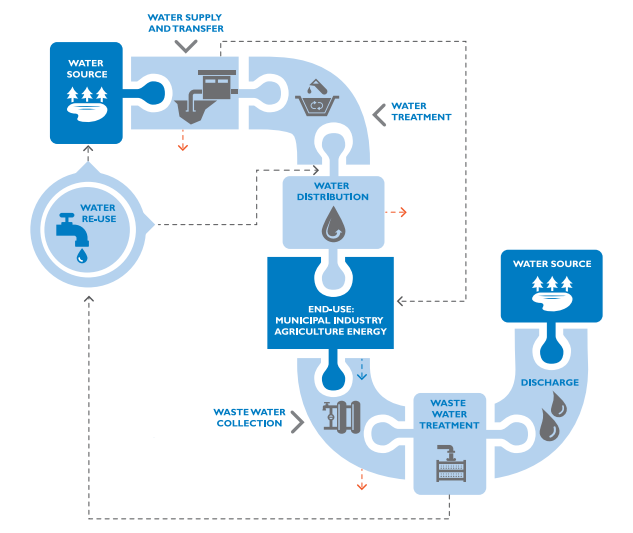

Water and energy are reciprocally linked resources. Energy needs require water, often in large quantities, for mining, fuel production, hydropower, and power plant cooling, and energy is needed for the pumping, treatment, and distribution of water and for collection, treatment, and discharge of wastewater. The water sector is a major consumer of energy at the global scale with recent estimates indicating total energy consumption from all sources by the water sector worldwide was around 120 million tonnes of oil equivalent (Mtoe). A majority of this energy wasin the form of electricity, corresponding to four percent of total global electricity consumption (1). The interdependency of these resources underpins economic growth, society and the well-being of our communities.

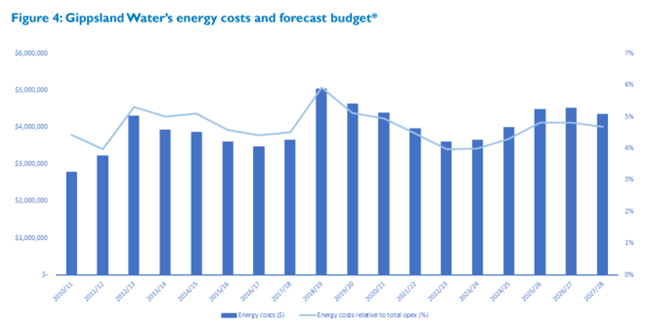

Due to energy-intensive processes in the water sector, energy remains among the highest operational expenditure items for water and wastewater service delivery providers. For our business, energy represented an average of 4.1 percent of total operational expenditure over the last eight years and is following an overall upward trajectory.

Similarly, given their high use of conventional sources of electricity, the delivery of water and wastewater services are also a significant source of carbon emissions. Our energy-related carbon emissions comprise around seventy-four percent of our overall emissions output.

For these reasons, energy represents a critical strategic concern for the water sector, underpinning the most fundamental aspects of water and wastewater services in terms of both economic and environmental sustainability, as well as continuity of service delivery.

Energy consumption in the water sector today

In recent years, the amount of energy consumed by the water sector globally was almost equivalent to the entire energy demand of Australia. About sixty percent of that energy was consumed in the form of electricity, corresponding to a global demand of around 820 terawatt-hours (TWh), or four percent of total global electricity consumption. Within Victoria, the water sector is among the top twenty highest electricity consuming businesses (2).

The Victorian water sector is responsible for the largest proportion of government emissions, contributing twenty-four percent of the state’s total emissions (3). The high consumption of energy within the water sector is due to the energy-intensive nature of water and wastewater service delivery. Energy is required in each step of the process in delivering these services (see Figure 2). At the global level, the most energy intensive processes in the water sector include the extraction and transportation of groundwater and surface water (forty percent), followed by wastewater collection and treatment (twenty-five percent). In developed countries, the largest share of water- related electricity consumption is used for wastewater treatment (forty-two percent) (4).

The level of energy consumption of each process within water and wastewater system is a function of several variables including geographic locations of assets, topography, quality of raw product and required level of treatment.

The future of energy consumption in the water sector

Global electricity consumption in the water sector is projected to nearly double between now and 2040. The IEA’s World Energy Outlook shows a general trend toward increased energy intensity of the water sector. While the reasons for this trend differ by country, the most universal drivers are increased population which drives high growth in domestic and industrial water withdrawals, increased amounts of wastewater being treated to higher standards, and an increased reliance on non-traditional water sources that require greater energy inputs. In Australia, use of electricity across the water sector is growing rapidly due to diversification of the water supply options to meet water security challenges driven by drought, population growth and declining long-term average inflows. These new water sources and associated treatment requirements provide a greater level of long-term water security but are typically more energy intensive compared to traditional gravity-fed sources from protected catchments (5).

Regulatory changes are also placing upward pressure on energy intensity of water processes. The Victorian water sector is renowned for its world standard water and wastewater services, and this is partly the result of a stringent regulatory framework for water and wastewater treatment. However, implementation and maintenance of these standards to ensure water supplies are fit for purpose require significant energy inputs (6).

More locally, a key external driver of energy consumption will be population growth in Gippsland, which is projected to grow by around twenty-six percent over the next twenty years, and the number of households (i.e., potential new domestic connections) expected to grow by nearly thirty percent, increasing pressure on both water and wastewater systems (7). At the same time, a potential decline in rainfall throughout the region because of climate change may exacerbate increased energy requirements for our business as new water sources are sought, particularly within our Tarago, Latrobe, and Thompson-Macalister water systems (8).

Background continued

The energy-water policy context in Victoria

Energy management is a new strategic focus for the water industry in Victoria. As large consumers of electricity, the sector has become increasingly aware of its exposure to higher costs and are seeking to take collective action where possible.

The Victorian Government's Climate Change Strategy includes a commitment for electricity used in government operations to be 100 percent renewable by 2025.

To assist there exists a myriad of upgrade programs and certificate schemes that are designed to help consumers reduce their energy usage and greenhouse gas emissions, as well as additional schemes to aid the production of renewable energy.

Under the Small-Scale Renewable Energy Scheme, eligible small-scale renewable energy systems are entitled to a number of small-scale technology certificates. One Small-Scale Technology Certificate (STC) is equal to one megawatt hour of eligible renewable electricity either generated or displaced by the system (9).

Also, an accredited power station may create large- scale generation certificates (LGCs) for eligible electricity generated by the power station’s the power station’s renewable energy sources. One LGC can be created per megawatt hour (MWh) of eligible electricity generated by a power station (10).

Through the Essential Services Commission, the Victorian Energy Upgrades Program helps Victorians reduce their energy bills and greenhouse gas emissions by providing access to discounted energy efficient product and services. Victorian Energy Efficiency Certificates (VEECs) are electronic certificates created under the program when certain energy efficiency activities are undertaken in residential or non- residential premises. Each certificate represents one tonne of greenhouse gas emissions reduction (CO2-e) (11).

We must continue to leverage these schemes to ensure all initiatives receive the highest level of support and continue to be mindful of the value of certificates and their impact on expected future revenues. The Victorian Government's Climate Change Change Strategy includes a commitment for electricity used in government operations to be 100 percent renewable by 2025.

To assist there exists a myriad of upgrade programs and certificate schemes that are designed to help consumers reduce their energy usage and greenhouse gas emissions, as well as additional schemes to aid the production of renewable energy.

Under the Small-Scale Renewable Energy Scheme, eligible small-scale renewable energy systems are entitled to a number of small-scale technology certificates. One Small-Scale Technology Certificate (STC) is equal to one megawatt hour of eligible renewable electricity either generated or displaced by the system9.

Also, an accredited power station may create large- scale generation certificates (LGCs) for eligible electricity generated by the power station’s the power station’s renewable energy sources. One LGC can be created per megawatt hour (MWh) of eligible electricity generated by a power station (10).

Through the Essential Services Commission, the Victorian Energy Upgrades Program helps Victorians reduce their energy bills and greenhouse gas emissions by providing access to discounted energy efficient product and services. Victorian Energy Efficiency Certificates (VEECs) are electronic certificates created under the program when certain energy efficiency activities are undertaken in residential or non- residential premises. Each certificate represents one tonne of greenhouse gas emissions reduction (CO2-e)(11).

We must continue to leverage these schemes to ensure all initiatives receive the highest level of support, and continue to be mindful of the value of certificates and their impact on expected future revenues.

The energy market

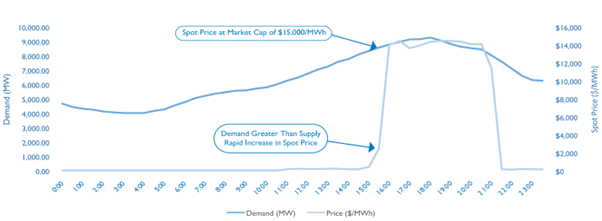

The National Electricity Market (NEM) has been the wholesale market for the supply of electricity for Queensland, New South Wales, ACT, Victoria, South Australia and Tasmania since late 1998.The Australian Energy Market Operator (AEMO) is responsible for the management of the NEM, ensuring that electricity demands are met with the lowest cost supplies. AEMO operates a spot market where energy generators bid at market intervals for specific quantity of energy supply for each state region. AEMO then selects the lowest bids to meet the expected demand at each time and despatches that required generation. These market spot prices may fluctuate between -$1,000 and $15,500 per MWh (12).

The Australian Energy Market Commission (AEMC) was set up by the Council of Australian Governments (COAG) and came into operation in July 2005. The AEMC makes the rules for the NEM and provides advice to governments on how to best develop the energy market over time.

Also established in July 2005, the Australian Energy Regulator (AER) is the regulator of the wholesale electricity and gas markets in Australia and is part of the Australian Competition & Consumer Commission (ACCC). The AER has many functions including regulating the revenues of transmission network service providers (TNSPs) and distribution network service providers (DNSPs), establishing service standards, monitoring compliance, pricing and investigating breaches.

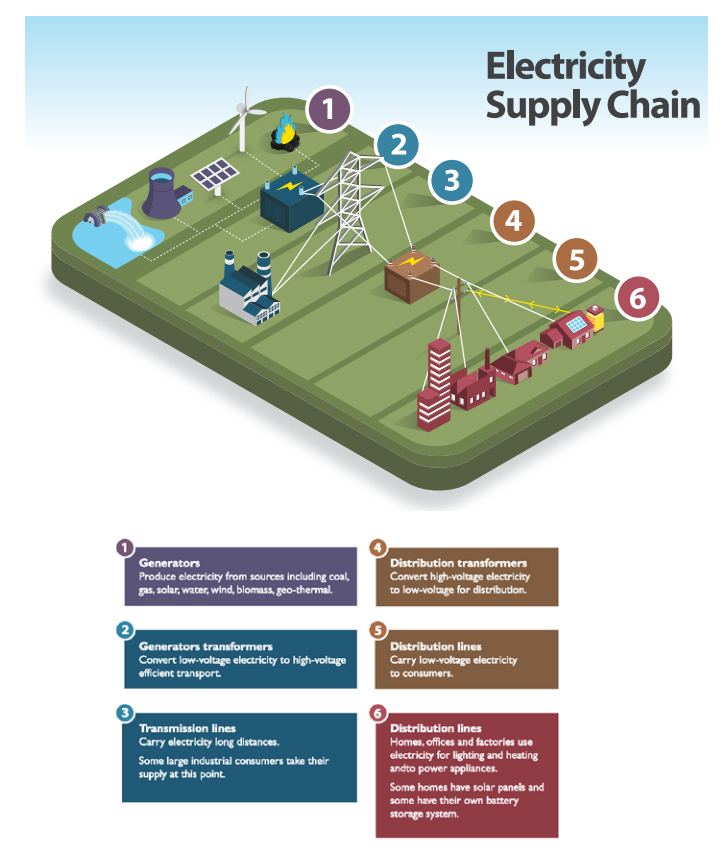

Other NEM participants in the electricity supply chain include Distributed Network Service Provider (DNSP) and Transmission Network Service Provider (TNPS) companies that manage physical distribution networks for the distribution of electricity, and market customers such as retailers who buy electricity at the spot price and sell to its own consumers, or consumers that buy electricity at the spot price directly from the market (see Figure 3).

As a consumer, it is important for our business to have a thorough understanding of the key functions provided by any retailer because the retailer provides the fundamental interface to the NEM. The retailer is responsible for aggregating the various charges that must be paid by the consumer that reflect the range of costs associated with electricity consumption, including the operations of the NEM, electricity transmission, metering and obligations from legislated renewable energy supply targets. It is the fundamental responsibility of the retailer to ensure its customer has adequate supply available to suit its demands at any time.

The most significant risk to the retailer is that the amount of energy required by its customer may exceed the demand as predicted by the retailer, or that the price of that energy exceeds the retailer’s own forecasts. Consequently, the retailer includes safety margins in their cost which are reflective on its level of certainty for the future energy needs of its customer.

Trends in energy management in the water sector

Water utilities around the world have responded to the challenges of increasing energy intensity in a range of ways. Importantly, many have recognised that a rise in water demand does not necessarily have to be accompanied by an equal rise in energy demand or energy costs.

Some of the more common approaches adopted around the world to improve energy management include the integration of energy and water policymaking, optimisation of processes and infrastructure for efficiency, improvement in monitoring and analysis capabilities, utilisation of energy embedded in wastewater, boosting on-site generation capacity, shifting to less energy intensive water sources, and water saving initiatives to augment demand.

However, there are also significant barriers to improving energy management in the water sector. Some widely acknowledged barriers include risk aversion within the water sector, prohibitive cost of generation initiatives and the impact of customer tariffs, increased regulatory and compliance standards, difficulty in deploying energy management controls to frontline operators, and the difficulty in replicating successful initiatives across facilities that vary widely in their system and plant specifications.

Our current situation

Our current approach to energy management

Like most industries in Australia, we enjoyed low energy costs in comparison to other operating costs. While all aspects of service delivery are heavily dependent on the consumption of energy, the relatively low cost of that energy has meant there has been limited perceived business need for investment in developing a thorough understanding and managing energy usage. In recent years, we have recognised the need for a deliberate and coordinated approach to energy management and have begun to develop our capabilities.

Supply and contracts

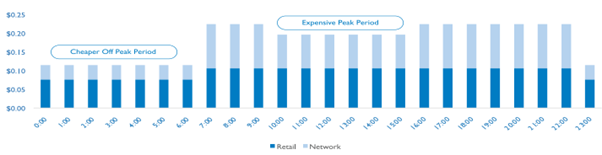

While historically we have executed large and small market retail contracts that have been very successful in maintaining low retail charges, the current retail agreements that became effective in July 2018, saw the peak and off-peak retail charges increase from 4.3489 cents per KWh (c/kWh) and 2.6551 c/kWh to 10.6052 c/kWh and 7.5736 c/kWh respectively.

Our retail contracts include invoice modelling and verification services that have been instrumental in delivering savings by verifying the most efficient network charges for individual sites. These network charges that are billed by the local network distribution company are also set to increase by approximately 1-2.5% over the 2023-2028 period. These changes have increased our annual energy budget by approximately 35% for the 2021/22 financial period to approximately of $3.9M.

Our energy invoices are received monthly in accordance with our current retail agreement, and are comprised of several changes including:

- metering and market operator’s charges, which are fixed

- environment schemes, linked to government policies and based on total consumption

- network charges, that are driven by time of use, capacity and demand

- retail charges, based on time of use

Network charges are complex and applied individually to each separate market meter. In addition to peak network tariffs, capacity and demand tariffs are also applied that are reflective of supplying an individual sites maximum demand at any one time and having further capacity to supply that demand during critically high peak usage times.

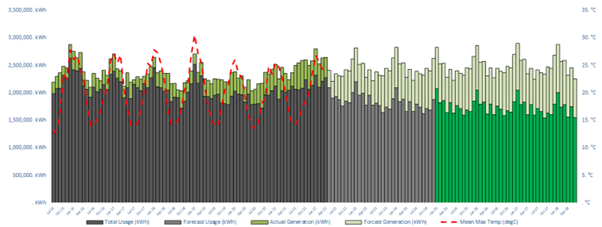

Energy generation

Currently we operate two main renewable energy generators, a 1.2MWp photo-voltaic solar system, a 385kW mini-hydro and a two 440kW biogas generators, that generate electricity at our Gippsland Water factory facility. We also have an additional 1.4MWp of photo-voltaic solar systems distributed at other facilities.

Energy efficiency initiatives

We have been an early adopter of variable speed drive technology and have built up a large network of assets that can be operated at various flows and pressures.

This technology has been successfully leveraged across numerous assets to ensure systems are run efficiently while maintaining performance specifications. The process of analysing and optimising these systems is on going and labour intensive using some purpose-built tools readily available for support.

Load shedding events

The current response to electricity network events such as load shedding and demand response in our business is currently limited to a handful of sites.

While the response at these sites is well automated, there remains significant effort for the management and coordination of this approach and there is much scope for a more seamless response across a much larger number of assets.

Energy Optimisation Specialist role

We have been proactive with the appointment of an Energy Optimisation Specialist with the key role of developing this strategy and supporting the adoption of energy initiatives with support from the rest of the business. Coordination and management of strategic energy initiatives is vital to delivering strategic outcomes and ensuring the business remains sustainable within an increasingly volatile energy market.

Infrastructure planning

Currently energy efficiency remains partially embedded into the asset design and procurement process. The impacts of energy consumption of plants and assets are considered amongst other considerations but aren’t a strong focus of current asset management strategies.

Gippsland Water’s energy management performance

Energy costs

For our business, energy represented an average of five percent of total operational expenditure over the last eight years and is following an overall upward trajectory with a significant step increase occurring in 2018/19. Figure 4 shows a sharp increase in energy costs in 2018/19 as a higher retail agreement came into effect reflective of market price increases from carbon policy and retirement of generation capacity. Our continued investment in renewable generation will provide some relief to electricity prices. It is expected that prices will continue to rise further into the future with our network and environmental costs rising steeply.

The budgeting and forecasting of energy usage needs to be accurately baselined against projected growth and expected impacts on future service delivery. These forecasts can also be more effectively coordinated with system plans to reflect any future impacts of asset creation, renewals and replacements.

Energy consumption

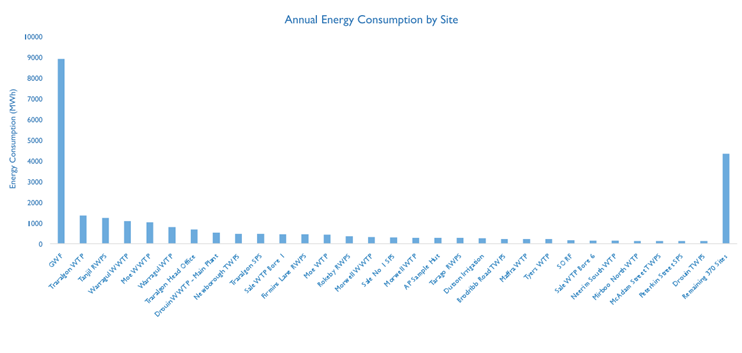

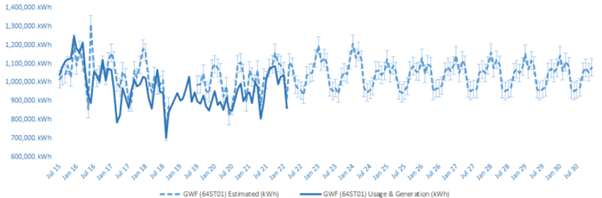

We operate approximately 400 separately metered sites, with 83% of our total usage being consumed by our top 30 sites.

The patterns of energy consumption across these sites varies significantly. Generally, it can be expected that sites performing similar functions, such as water and waste treatment, may observe similar patterns of consumption. However, there is great variance in the configuration, types of technology being utilised as well as the overall utilisation capacity of the sites such that the each of the larger sites energy consumption must be analysed individually.

Current residual risks

Increased tariffs

With energy such a fundamental input for our services, and that cost of energy rising significantly, there is a clear risk that these costs cannot be absorbed and may need to be passed onto our consumers. We must build our ability to avoid higher energy prices, but we must also do so without compromising the quantity and quality of our services.

Interrupted service

While market mechanisms such as very high spot prices and demand tariffs attempt to limit consumption at times of critically high demand. The recent necessity of load shedding to stabilise the electricity grid, has demonstrated that energy supply at such critically high demand times is becoming less reliable. Continued service delivery will require the augmented supply of energy from alternate behind-the-meter energy sources such as diesel generators and renewables like hydro and biogas generators as well as photovoltaic systems. The adoption of such alternative energy systems also represents an opportunity to generate revenue by supplying any remaining energy back into the energy market. With the frequency and duration of unplanned outages increasing (14), such interruptions will pose a greater risk to the continuity of our own services.

Opportunities for energy generation

We must continue to be mindful of the current and projected value of any incentive or generation schemes we may be leveraging to support energy reduction initiatives, and fully comprehend the financial sensitivities these additional markets may cause.

Future policy changes

There currently exist two major standards for the treatment of water and waste in Victoria with which we must comply. These are the Safe Water Drinking Act (SWDA) and the State Environment Planning Policies (SEPP). It must be considered that any changes to these standards would have a direct effect on energy consumption either positive or negative.

Missed efficiency opportunities

We have constructed a strong foundation for development of energy efficiency initiatives, and with this strategy in its early stages, there exists significant opportunities for further development and implementation. Businesses must innovate in how they manage their energy requirements, or their profitability will suffer. A good energy strategy can reduce energy costs by as much as 50% compared with traditional thinking (15).

Strategic framework for energy management

This Strategy is primarily concerned with the goal of reducing the energy costs incurred by us because of its energy consumption so as to ensure business sustainability and continuity of service in the long term. Accordingly, this section will provide an analysis of the primary drivers of those costs and identify the most viable levers of control that will help it advance toward that goal. This assessment will provide the strategic framework for the specific initiatives recommended in Section 4.

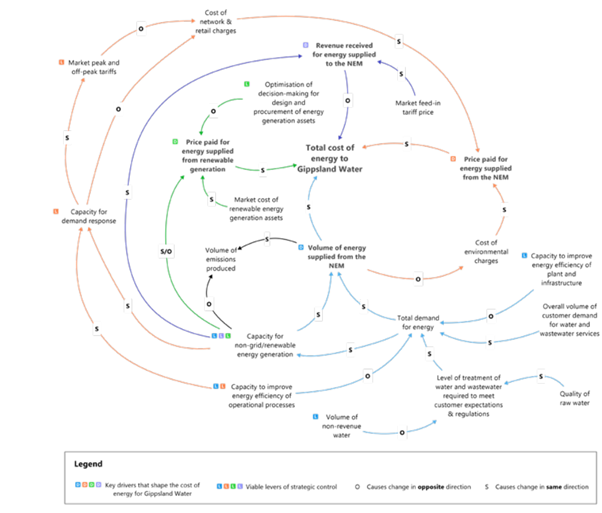

The four drivers of our energy costs

Four primary drivers are identified as determining the overall cost of energy for our business. These drivers are:

- Volume of energy supplied from the NEM;

- Price paid for energy supplied from the NEM;

- Price paid for energy supplied from renewable generation; and

- Revenue received for energy supplied to the NEM.

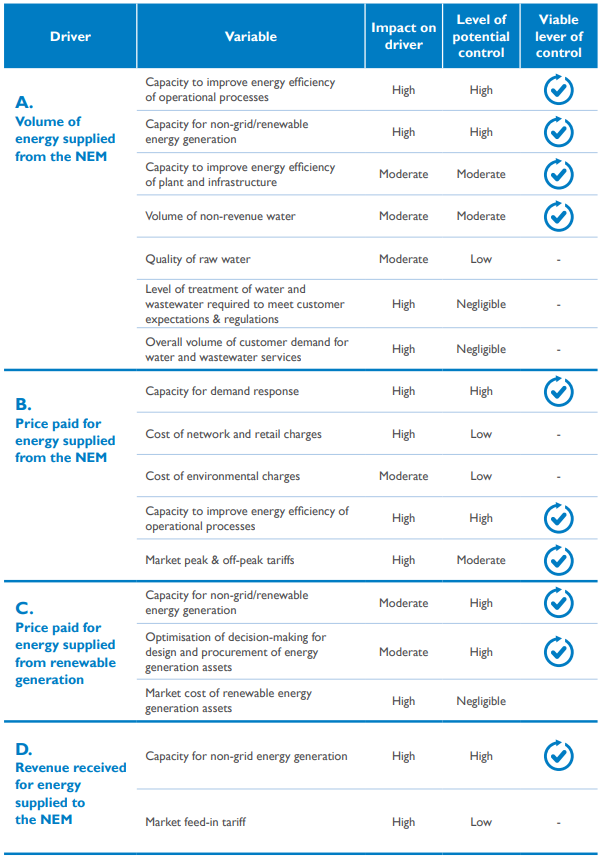

These drivers each comprise a broader set of interdependent variables that together shape the cost of our energy.

Each variable differs its impact on the overall cost of energy, and also in the extent of the control we have over each variable. Table 1 provides an assessment of these variables, with those of moderate to high impact and a moderate to high level of control representing the most viable levers of control and most promising areas for our strategic focus.

Driver 1: Volume of energy supplied from the NEM

The volume of energy supplied to our business is closely correlated with the demand for our services and the quality of those services. Treated water systems must continue to supply clean and safe drinking water and wastewater treatment systems must continue to process waste in alignment with customer demands and expectations as well as compliance standards. As the demand or requirements for those services increases, influenced predominantly by local weather conditions, energy consumption also increases.

While level of demand and treatment standards remain largely beyond our control, the energy required to deliver those services can be reduced, primarily through augmentation and improved efficiency of the processes and infrastructure systems used to deliver those services. To this end, we could potentially reduce the overall energy requirements of our systems by improving our ability to accurately measure, monitor and report on energy usage in relation to the various aspects of service delivery and identify opportunities to improve efficiency, including through process improvement, the augmentation and management of plant and infrastructure systems.

Where deemed financially sustainable, continued investment in behind-the-meter renewable technologies also enables the generation of our own electricity, thereby reducing our overall requirement for grid energy sourced through the NEM.

Driver 2: Price paid for energy supplied from the NEM

As per section 2.1.5, energy retailers typically build margins into contracted tariffs in order to mitigate the risk of incurring costs associated with customer demand or wholesale energy prices exceeding the retailer’s forecasts. To that end, the price paid for energy supplied from the NEM is at least partly influenced by our own ability to remain within forecasted demand and reduce our retail customer risk profile.

Building capacity for demand response – the ability to reduce our requirement for grid energy for brief periods – would enable our business to avoid periods of higher cost in the NEM, thereby influencing our risk profile from the perspective of energy retailers, and in turn the overall price paid for energy supplied through the NEM. Building this capacity includes configuring daily operations to utilise system capacities to avoid market tariffs imposed throughout the day, as well as responding to market mechanisms to limit energy consumption during critical peak demand periods through the curtailment of load and the use of backup generators to greatly reduce the exposure to very high market price events.

Driver C: Price paid for energy supplied from renewable generation

Renewable energy generation has proven very effective in providing an alternative energy supply and reducing energy supplied from the NEM as well as effectively reducing carbon emissions. In alignment with Driver A, building scalable capacity for behind-the-meter renewable energy generation is an important lever of control to ensure that renewable energy investment remains cost-effective. In addition, ensuring the application of a robust decision-making framework is applied when scoping, designing and procuring renewable energy generation technologies will help ensure that the only initiatives to proceed include those which demonstrate a competitive price per kilowatt hour in comparison to grid energy, thereby contributing to lowering the overall cost of energy to our business.

Driver 4: Revenue received for energy supplied to the NEM

Any increase in our capacity to generate electricity presents the opportunity to feed energy back into the grid and acquire new source of revenue, offsetting some of our overall energy costs.

Accordingly, regardless of the means of generation our business should exploit its generation capacity to secure the best price for any energy supplied back into the market. The timely dispatch of generation at times of critically high demand will be greatly beneficial to the local electricity network infrastructure and we must be conscious of fully leveraging our generation assets for additional revenue.

However, although we can increase our generation capacity, we cannot control market feed-in tariff prices. Therefore, we should be conscious of the future forecasts for energy supplies and remain careful not to over-invest in generation systems that may deliver limited benefit into a saturated market.

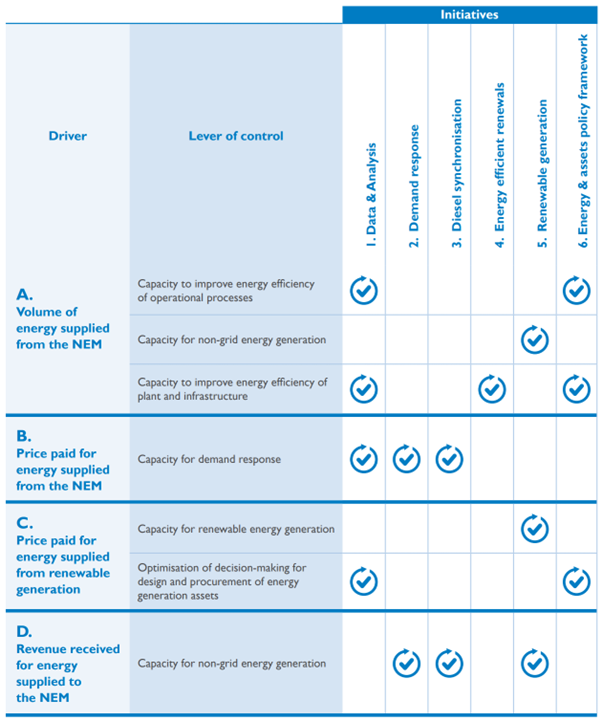

Strategic options

To reduce the cost of energy, we must adopt an integrated whole-of-business approach to energy management. This approach must be strategic insofar as it responds directly to the underlying drivers of energy cost and prioritises resources toward affecting controllable variables likely to yield the highest impact.

Accordingly, this Strategy identified six recommended initiatives that form part of a holistic and integrated approach to influencing the drivers of energy costs in our business (see Table 2). The following section describes the purpose of each initiative and its expected benefits with respect to the goals of this Strategy.

Recommended initiatives

Initiative 1: Build our capacity to capture and analyse energy data

Purpose

To develop the tools and capabilities enabling a thorough understanding of our energy use at the site level and build capacity to identify opportunities to improve the energy efficiency of our processes, plant and infrastructure systems. These tools and capabilities will be vital to drive a culture of energy awareness that generates and supports changes to energy usage throughout the whole organisation. It is this development of knowledge and the culture of change that underpins all of our initiatives.

Description

The development of data tools, dashboards and reporting is critical to supporting decision makers with accurate and reliable information so that they can make well-informed, timely decisions.

As our business builds our understanding of the energy market and costs of energy use in relation to service delivery, we will be able react appropriately to market volatility and reduce operating costs as well as identify new opportunities to improve the energy efficiency of plant and processes.

Operational data should be effectively integrated with energy usage data, to provide key performance indicators that provide accurate and timely information. The key performance indicators for this strategy will be:

- Cost of Energy Consumption and Treated Volume ($ per kL)

- Cost of Energy Consumption and Energy Consumption ($ per kWh)

- Additionally, other operational key indicators will be adopted for assessing cost saving and efficiency initiatives, including:

- Treated Volume and Energy Consumption (kL per kW)

- Peak Energy Consumption and Off-Peak Treated Volume (kL to kL)

- Peak Energy Consumption and Off-Peak Energy Consumption (kW to kW)

- Instantaneous Energy Usage (kW to kVA)

- Instantaneous Treated Flow (kL)

- Market forecasts and supply capacity

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

Dashboard and efficiency tool development |

2022/28 |

Tools that support decision making as well as verification and management of initiatives. |

|

Key performance indications and reporting for larger sites |

2022/28 |

Reporting that captures the performance of larger sites that incorporates baselines data and relevant information of performance. |

| Smart meter integration for larger sites | 2022/28 | The availability of real-time data for operational response |

Initiative 2: Build our capacity for demand response to the energy market

Purpose

To develop the capacity to respond rapidly and appropriately to market pricing events so as to reduce our customer risk profile and reduce the cost of sourcing energy from the NEM. This will include developing the ability to store or defer energy requirements water and waste systems to avoid higher cost periods.

Description

Our business must build our ability to react appropriately to the energy market by limiting our exposure risks and exploiting opportunities. Changes in the NEM are producing higher costs and causing greater volatility, and there is a clear expectation that environmental, network and retail charges are expected to continue to rise into the future.

Ignoring metering and market operator charges, the combined retail and network charges for the cost of consumption during peak times, is approximately double that of consumption at off-peak times (see Figure 7).

Periods of critically high demand and insufficient baseload supply cause market prices to peak sharply for long periods as the market pricing mechanism attempts to limit demand. Such extreme market prices are becoming increasingly more common over summer periods when demand is elevated (see Figure 8).

We must build our ability to decrease our energy consumption at peak times and limit our exposure to extreme price events. Such a response will include limiting service delivery by reducing plant flows and leveraging storage capacity where available.

Inversely, the oversupply of baseload power at times of insufficient demand are causing prices to crash to negative levels as the market attempts to stimulate energy consumption.

We must be able to exploit these very low-price events by increasing our energy consumption during such times, by increasing plant flows and filling storages to capacity.

The ability to respond quickly and appropriately to network and retail pricing events will not only reduce the current costs of energy consumption but will also benefit the negotiation of future retail contracts. Additionally, combining this response with current commercially available demand response schemes that reward size and reliability, will also provide opportunities to create revenue from both critically high and low market pricing events.

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

|

2022/28 |

The implementation of control software that successfully reduces the operation of a site/ system at peak retail and network rates. |

|

Deployment of demand response for water or waste system |

2022/28 |

The implementation of a control strategies that can minimise the power consumption of a system of assets in response to a peak demand event. |

Initiative 3: Synchronise our diesel generation to improve business continuity and demand response

Purpose

To help build our capacity for demand response to influence the cost of energy from the NEM, while also improving our ability to leverage generation capacity during times of critically high demand to improve the price of supplying electricity back into the NEM.

Description

The increasing frequency and duration of unplanned outages and load shedding events to help stabilise the electricity grid, is already having an impact on our ability to supply our own services at times of critically high peak demand. Without the supply of energy from the grid, treatments plants and pump stations must rely on storage capacity to ensure service in maintained. Sites without sufficient storage and sites with critical treatment processes must then rely on diesel generators for continuous supply of energy and continuity of service. These diesel generators may be embedded into the electricity grid, to not only ensure seamless synchronisation, but to allow for excess energy to be supplied into the electricity grid. This excess energy may then be added to any demand response program, increasing both the size and reliability of our overall ability to react to the energy market. This has proven our most effective form of demand response.

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

Embedded Diesel Generation at Traralgon WTP, GRO, Neerim , Maffra, and more |

2022/28 |

Proven capability to despatch embedded diesel generation with no impact to normal service delivery |

|

Ongoing identification of opportunities for future backup generation |

2022/28 |

Viable list of projects that can be managed holistically across the business |

Initiative 4: Pursue energy efficient equipment renewals and replacements

Purpose

To improve the energy efficiency of equipment and processes so as to reduce the volume of energy that is supplied through both the NEM and any renewable sources.

Description

Our business operates a diverse range of electrical equipment in the various treatment and pumping processes utilised throughout our own supply network. By identifying and understanding plant and equipment consumption in relation to service delivery, we will be able to look for alternatives that effectively reduce our overall energy consumption and greenhouse gas emissions.

The well-managed renewal and replacement of electrical loads, such as lighting, pumps and blowers, will give our business the ability to leverage several incentive schemes that increase the attractiveness of such upgrade initiatives. These programs may also be accessed for further incentives that operate existing equipment more efficiently.

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

LED lighting upgrades in remaining offices and depots |

Ongoing |

The successful replacement of LED lighting that qualifies for certificate generation. |

|

System efficiency improvements - VEECs |

2022/28 |

The successful implementation of an energy efficiency modification that qualifies for certificate generation |

Initiative 5: Invest in renewable energy generation

Purpose

To build our capacity to cost-effectively generate larger volumes of behind-the-meter energy in order to reduce the volume of energy that must otherwise be supplied from the NEM, while also reducing our carbon footprint.

Description

Our business has a strong history of successfully utilising renewable energy sources such as the 300kW hydroelectric generator at Pine Gully, that supplies energy via a private high voltage transmission line to the Gippsland Water Factory. Such renewable energy sources have a proven impact on lowering overall energy consumption as well as decreasing carbon emissions.

We must continue to pursue additional cost-effective opportunities for renewable generation in support of our climate strategy and goal to lower our overall cost of energy consumption.

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

Deployment of 1.5 MW of PV Solar systems |

2023/28 |

Delivery of behind-the-meter generation that deliver certificates at identified various sites. |

|

Deployment of 70kW mini hydro at Traralgon WTP |

2022/23 |

Delivery of behind-the-meter generation that delivers certificates |

Initiative 6: Adopt an integrated energy management and assets policy framework

Purpose

To formulate and implement a policy framework that will guide any decision-making activity across the business that is reasonably expected to have implications for energy use or energy-related costs.

Description

Consideration for impacts on energy consumption is not yet embedded uniformly across our asset design, procurement, maintenance and operations processes.

Through the development and integration of a set of evidence-based decision-making principles into all decisions where a potential impact on energy consumption exists, it is expected we will further maximise our ability to locate and realise opportunities for energy efficiency, be it in operational process or in plant and infrastructure design. Further, these principles will also be designed to govern decision making around the design and procurement of energy generation assets, ensuring their long-term financial and environmental sustainability, i.e., that they produce a net saving in real terms in both the short and long term.

Scope

| Deliverable | Timeframe | Expected outcome |

|---|---|---|

|

Policy framework for energy management decision-making |

2023/28 |

Create and manage register of energy initiatives with assumptions that are well tested and sensitivities that are well understood. |

An evolving strategy – beyond 2028

The above initiatives are recommended to be executed in a staged manner between 2022 and 2028 in accordance with the Implementation Plan. Given the rapid dynamics of the energy industry it is recommended that this strategy be reviewed annually. Further, a comprehensive review of strategic outcomes resulting from the above initiatives will be undertaken in 2028 to prepare for the development of the next iteration of this Strategy.

In weighing strategic options for this Strategy, some initiatives considered were assessed as more appropriate for inclusion in the later generations of our Energy Management Strategy, scheduled for delivery in 2028. Our 2028 strategy consider the inclusion of the following initiatives:

- Quantify and reduce our embodied energy consumption, i.e., identify where our business is indirectly incurring the cost of energy due to the consumption of energy intensive goods or services where alternatives may be available.

- If our ultimate goal is to reduce costs associated with energy, one very lateral way of doing that is reduce our dependency on energy-intensive products and services.

- Adoption of a carbon and cost-neutral asset planning and procurement that simultaneously manages the requirement for new or renewed infrastructure with a requirement to offset the emissions and cost-of-energy impacts of that infrastructure through renewables or offset acquisition.

- Evaluation of decentralised or other alternative water and wastewater system network configurations for both system reliability and energy efficiency compared with the status quo network, with a view to determining opportunities for substantive network restructuring in the medium to long term where viable.

-

Investigate options to influence customer behaviours to improve adoption of waste and water saving (and therefore energy saving) measures, or the adoption of water/wastewater service usage patterns that take advantage of off- peak energy tariffs.

Strategic alignment

These recommendations are strongly aligned with our strategic agenda. In particular, the development of this Strategy has been driven by a Strategic Action in the 2017-22 Strategic Priorities to ‘develop and deliver an energy management strategy’ that contributes to achieving ‘a greater than two percent reduction in electrical energy consumption’ by EOFY 2021/22.

This Strategy also provides the primary means through which we will progress toward our strategic objective of ‘investing in energy reduction and generation initiatives to reduce costs’, as per the 2019-24 Strategic Priorities.

Through a focus on reducing grid energy consumption and increasing capacity for renewable energy generation, this Strategy is also expected to support our carbon pledge. Specifically, our operations will be 100 percent renewable by January 2025 as required by the Victorian Government Climate Change Strategy

Finally, with an emphasis on careful investment in energy management, this Strategy also aims to help mitigate the priority strategic risks, namely, to avoid ‘inappropriate investment that does not leverage opportunities’.

Implementation

In alignment with the recommendations above, an strategic assessment has been devised to invest and coordinate each of the initiatives required to assist our business to achieve control of our energy-related costs as well as support emissions reduction activities.

While the energy industry remains increasingly volatile and susceptible to policy change and disruption, it is important for this strategy to remain agile. Consequently, it’s important for us to focus effort on initiatives that can be delivered in the short term, with careful consideration of any exposure or sensitivity to market conditions. This implementation of projects and initiatives must be reviewed frequently.

Resourcing

In order to continually control our cost of energy, continuous resourcing and investment is required by our business in each of the key strategic areas. It is important that the Energy Optimisation Specialist continue to strategically coordinate energy management activities with support from the rest of the business. Energy efficiency projects and initiatives must be incorporated into existing site improvement plans, business needs identifications and corporate plans to ensure energy remains strategic focus that is consistently considered throughout all business activities.

We will continue to leverage our data for advanced analysis and forecasting through continued investment in emerging technologies, including the use of machine learning and artificial intelligence.

Responsibilities

The Executive Leadership Team (ELT) are responsible for endorsing the strategy and supporting its implementation and delivery and resulting business plans. They are responsible for leading cultural changes and championing cost saving and energy reduction initiatives as well as informing and interacting with the Gippsland Water Board. The ELT will continue to support a strategic agenda around energy management and ensure this strategy remains well aligned and effective.

The General Manager Assets is responsible for communicating the strategy to Executive Leadership Team and supporting the team in implementing and measuring the actions for success. The General Manager is also responsible for regular reporting to the Board on the progress of the strategy.

The Energy Optimisation Specialist (EOS) is responsible for communicating the strategy throughout our business and supporting the implementation of projects and initiatives and measuring the actions for success. The EOS will be a visible and accountable leader of this strategy, ensuring energy management is well understood and embedded throughout the culture of the organisation.

Reporting

The operational performance of energy usage shall be continuously monitored throughout the life of this strategy as energy initiatives implemented and maintained. This will help ensure that any learnings can be easily and transparently communicated throughout the business and that knowledge and culture is developed and supported.

The performance and effectiveness of this strategy, as measured by the specific deliverables outlined by each specific initiative, will be reported annually to our Executive Leadership Team and Board.

- International Energy Agency, ‘Water-Energy Nexus’ in World Energy Outlook 2016

- Victorian Water Industry Association, Water-Energy Nexus – Electricity Issues in the Victorian Water Sector, September 2011.

- Victorian Department of Environment, Land, Water and Planning, Climate Change, https://www.water.vic.gov.au/water-industry-and-customers/your- water-suppliers-performance/climate-change, 2019.

- International Energy Agency, ‘Water-Energy Nexus’ in World Energy Outlook 2016

- Victorian Water Industry Association, Water-Energy Nexus – Electricity Issues in the Victorian Water Sector, September 2011.

- Victorian Water Industry Association, Water-Energy Nexus – Electricity Issues in the Victorian Water Sector, September 2011.

- DELWP, Victoria in Future 2016: Population and household projects to 2051.

- Gippsland Water, Urban Water Strategy. https://www.gippswater.com.au/residential/our-community/get-involved-op…- strategy, 2022

- Australian Government Clean Energy Regulator, http://www.cleanenergyregulator.gov.au/RET/Scheme-participants-and-indu…- Installers/Small-scale-generation-certificates, 2019.

- Australian Government Clean Energy Regulator, http://www.cleanenergyregulator.gov.au/RET/Scheme-participants-and-indu… Large-scale-generation-certificates, 2019.

- Essential Services Commission, Victorian Energy Upgrades Program, https://www.esc.vic.gov.au/victorian-energy-upgrades-program/about-vict…- energy-upgrades-program/victorian-energy-efficiency-certificates-veecs, 2019

- Michael Williams, Power Profits – A comprehensive 9-step framework for reducing electricity costs and boosting profits, 2018.

- Australian Energy Market Operator (AEMO), https://www.aemo.com.au/About-AEMO/About-the-industry, 2019.

- ESC, Victorian Energy Market Report March 2020-21.

- Michael Williams, Power Profits – A comprehensive 9-step framework for reducing electricity costs and boosting profits, 2018.

- Gippsland Water’s Asset Planning team has already initiated investigations to identify opportunities to reduce suspected non-revenue water in our systems. These efforts will contribute to improving energy efficiency, although fall outside the scope of this Strategy.

Delpoyment of tariff avoidance control software

Delpoyment of tariff avoidance control software